Basic Views on Corporate Governance

The Kyocera Group shall establish proper corporate governance by implementing the "Kyocera Philosophy." The Kyocera Group always strives to maintain equity and fairness and faces all situations with courage and conscience. It will realize its management rationale by achieving sustainable growth and raising medium- to long-term corporate value, while maintaining the soundness and transparency of management and taking into consideration the standpoints of all stakeholders. In doing so, the Kyocera Group shall always pursue optimal systems to undertake fair and efficient corporate management while evolving and progressing continually.

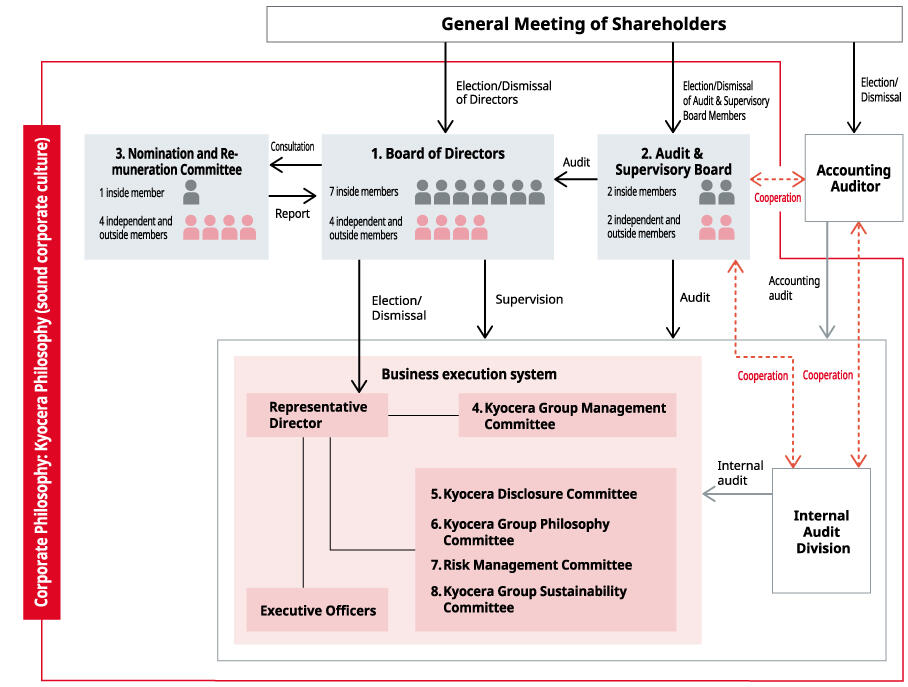

Systems

The Company has selected a company with an Audit &Supervisory Board as its organizational design.

The Board of Directors shall be composed giving consideration to the balance of experience and insight as well as diversity and appropriate size to make important decisions and supervise the execution of business for the Kyocera Group as a whole. The Company shall establish a Nomination and Remuneration Committee as an advisory body to the Board of Directors in order to ensure the objectivity and transparency of decision-making procedures regarding the nomination and remuneration of Directors. The majority of the Nomination and Remuneration Committee shall consist of independent Outside Directors.

Additionally, the Company shall set up the necessary committees in a timely manner to establish appropriate corporate governance.

1.Board of Directors

The Board of Directors of Kyocera is an organization to decide the important matters and supervise the execution of businesses of Kyocera Group as a whole. It consists of 11 Directors including 4 Outside Directors. The Directors are nominated at the General Shareholders Meeting based on their demonstrated understanding of Kyocera Group and their outstanding personal qualities, capability and insight.

2. Audit & Supervisory Board

Audit & Supervisory Board Members include two full-time Audit & Supervisory Board Members, originally employees of Kyocera, as well as two Outside Audit & Supervisory Board Members, who have plenty of knowledge and experience as CPA or an attorney-at-law.

The Audit & Supervisory Board Members are conducting audit of Kyocera as a whole based on the accurate information about Kyocera gathered from inside and utilizing variety of viewpoints as outsiders of Kyocera.

3. Nomination and Remuneration Committee

As consulting organization of the Board of Directors, Kyocera has established the Nomination and Remuneration Committee, the majority of which consists of Outside Directors. The Board of Directors examines nominations regarding Directors and Managing Executive Officers as well as the remuneration of Directors after consulting in advance with the Committee to ensure that the decision is made in a fair and appropriate manner.

4. Kyocera Group Management Committee

Kyocera has established the Kyocera Group Management Committee , which consists of Directors (excluding Outside Directors), Senior Managing Executive Officer, and Managing Executive Officers who live in Japan and meetings every month regularly. The Committee examines not only the agendas of the meetings of the Board of Directors, but also other important matters relating to the overall execution of Kyocera Group business to ensure sound management.

5. Kyocera Disclosure Committee

Kyocera has established an organ known as the the Kyocera Disclosure Committee for disclosure of corporate information. The Committee investigates all disclosure documents for the purpose of assuring the appropriateness of disclosures of corporate information, reporting the results of its investigations to the Representative Director and President, who educates Group companies concerning rules relating to disclosure and promotes appropriate disclosure of information for the entire Group.

6. Kyocera Group Philosophy Committee

Kyocera has established the Kyocera Group Philosophy Committee to educate and permeate "Kyocera Philosophy," which is our corporate philosophy setting forth the importance of conducting business of management in a fair and honest way, basing its fundamental judgments on a precept that "What do we consider to be the right choice as a human being?" The Committee sets the "Kyocera Philosophy" education policy for each entity in Kyocera Group, and discusses and decides upon measures to promote the understanding and practice of "Kyocera Philosophy".

7. Risk Management Committee

Kyocera has established the Risk Management Committee to handle Kyocera Group's risk management. This Committee determines risk management policies, and identifies corporate risks to be addressed by the Group.

8. Kyocera Group Sustainability Committee

Kyocera has established the Kyocera Group Sustainability Committee to promote the sustainable growth of both the Kyocera Group and society. This Committee discusses business strategies designed to provide solutions to societal needs, policies and targets regarding social requirements aiming to achieve the management rationale and SDGs.